The information and communication technology (ICT) industry is the fastest-growing sector in North Macedonia, playing a crucial role in job creation and export generation.

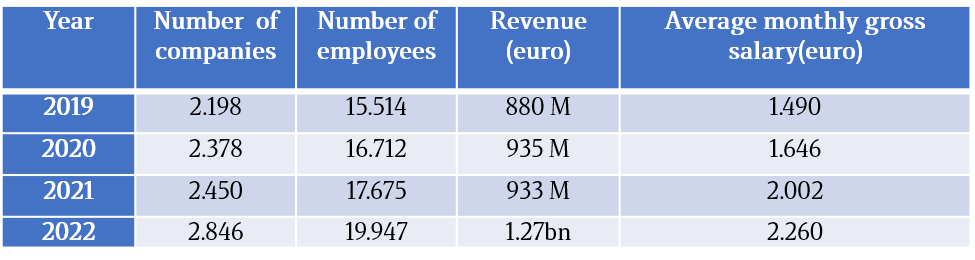

Source: ICT Chamber of Commerce, MASIT

North Macedonia boasts a highly skilled and technically proficient workforce, particularly in IT and software development. Many young professionals are well-educated, fluent in English, and adaptable to global industry standards, making it easier for companies to operate in international markets.

Labor costs in North Macedonia are significantly lower than in Western European countries, making it an attractive destination for outsourcing and nearshoring. This cost-effectiveness enables companies to maintain high-quality services while reducing operational expenses.

North Macedonia has invested heavily in developing a robust telecommunications infrastructure, including high-speed internet connectivity. This is essential for ICT companies to operate efficiently and deliver services seamlessly on a global scale.

North Macedonia offers a business-friendly tax regime, with a relatively low corporate tax rate. This creates significant cost savings for ICT companies, encouraging both foreign investment and sector growth.

The country has built a strong reputation for delivering high-quality software and IT services. Many Macedonian companies specialize in software development, cybersecurity, data analytics, and IT solutions that meet international standards.

A substantial portion of North Macedonia’s ICT companies are export-driven, serving international clients across Europe, North America, and beyond. This not only generates revenue but also fosters technology transfer and global collaboration.

North Macedonia’s strategic location in Southeast Europe provides companies with efficient access to European Union (EU) markets. This proximity enhances its attractiveness as a hub for businesses looking to expand into the broader European market.

The government has introduced various policies and incentives to support ICT sector growth, including foreign investment incentives, startup support programs, and initiatives to foster innovation.

The country has a well-established education system, with more than 80 high schools emphasizing languages, mathematics, and science, along with 22 universities producing a steady pipeline of ICT professionals.

North Macedonia offers a streamlined and transparent business environment, featuring a simplified company registration process and an efficient regulatory framework, making it easier for businesses to establish and operate.

MICROSOFT, CISCO, ORACLE, DELL, COMPAQ, HEWLETT, PACKARD, IBM, SUN, MICROSYSTEMS, APPLE, AND LOTUS are present in the country via branch offices, distributors, dealers, resellers, solution providers, and business partners.

The outsourcing industry is one of the fastest-growing branches within the IT sector, offering a wide range of services that help businesses reduce costs, improve efficiency, and access specialized skills. North Macedonia has become an attractive destination for outsourcing, particularly in IT services, thanks to its competitive labor costs, skilled workforce, and strong infrastructure.

One of the key competitive advantages of North Macedonia is the high level of language proficiency among its workforce. Approximately 40.0% of the population aged 25-34 speaks at least one foreign language, slightly exceeding the EU average of 38.7%.

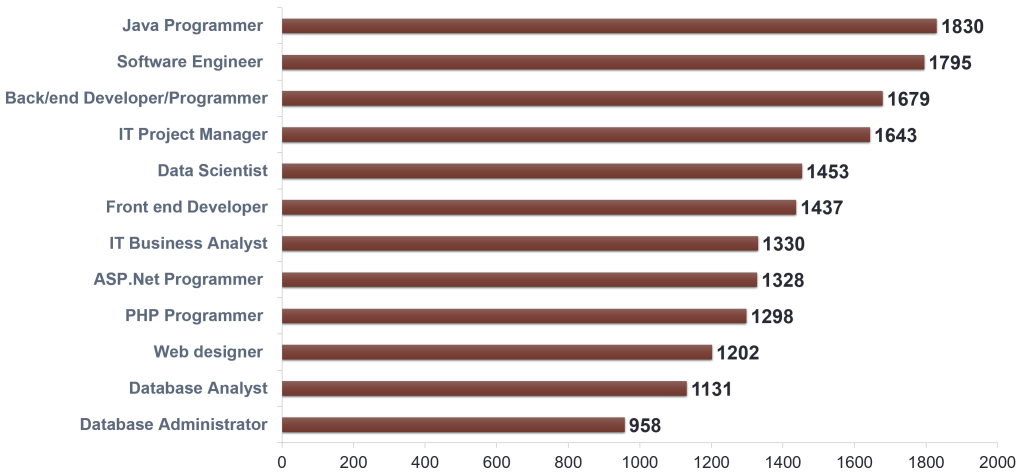

INCOME BY JOB POSITION (in euros)

The Macedonian outsourcing industry serves customers in 37 countries across Europe, North America, Asia, Australia, and the Middle East. The majority of ITO (Information Technology Outsourcing) and BPO (Business Process Outsourcing) companies in North Macedonia see the greatest potential for expansion in Scandinavian countries, Central and Eastern Europe, with North America continuing to be the top export destination. ITO companies make up the largest segment of startups in North Macedonia, reflecting the country’s growing strength in the outsourcing sector.

A number of international companies, such as Seavus (Sweden), Netcetera (Switzerland), M Soft (France), and 6 PM (UK/Malta), are developing software in North Macedonia for the export market. Additionally, several companies provide customer support for multinational IT firms.

Key trans-border companies operating in Southeast Europe with a presence in North Macedonia include S&T AG (Austria), Ness Technologies (Israel), Musala Soft AD (Bulgaria), Melon AD (Bulgaria), Matrix IT Ltd. (Israel), IN2 Group (Croatia), Endava Ltd. (UK), Dekra SE (Germany), Cisco Systems Inc. (USA), and Asseco SA (Poland). Furthermore, a growing number of companies from neighboring countries are tapping into the Macedonian labor market in the outsourcing industry by hiring freelancers or remote employees, even without establishing offices or subsidiaries in North Macedonia.